Building No-Code RAG for Chatting with Websites: 3-Step AI Workflow

As AI gets smarter, people want answers that are quick, accurate, and fresh. One smart way to do this is with Retrieval-Augmented Generation (RAG), which lets AI pull info in real time from all kinds of sources—websites, PDFs, CSVs, even databases. It's a game-changer for keeping things up to date without constant retraining.

Athina Flows makes it simple. It's a no-code tool to build AI workflows that tap into these sources, deliver sharp answers and enable everyone to automate their redundant tasks with AI. In this article, we'll show you how to set it up with a Tax Compliance Assistant RAG as an example.

How It Works: No-Code RAG in 2 minutes

Building AI that chats with websites in Athina Flows follows a simple, modular process:

- Capture User Queries

- Retrieve Information from URLs

- Generate Contextual Responses

Let’s break this down using the Tax Compliance Assistant as an example.

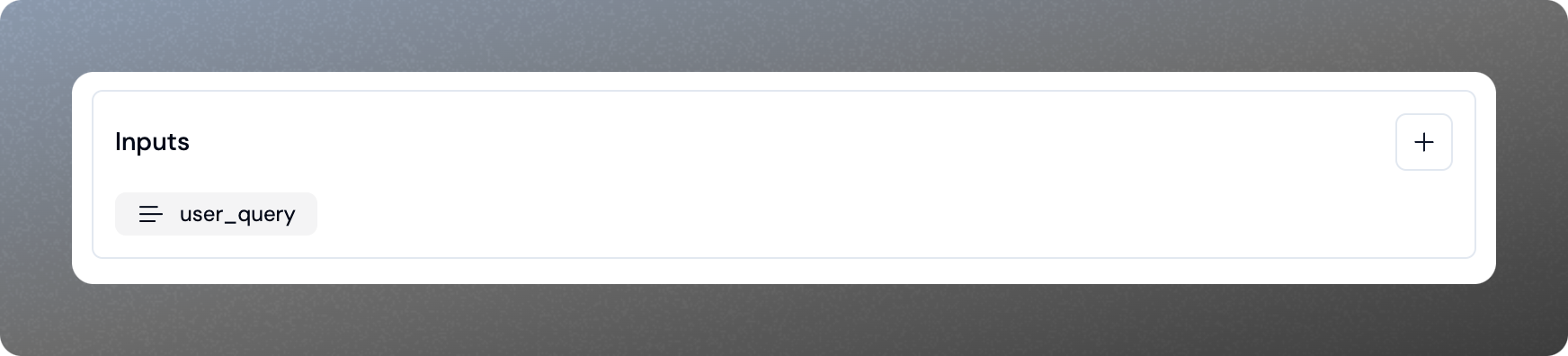

Step 1: Capturing User Queries

Users submit tax-related questions, and an Input Block processes the query.

Example Query:

"What tax deductions are available for small businesses in 2024?"

Instead of relying on static AI knowledge, Athina Flows dynamically retrieves relevant information.

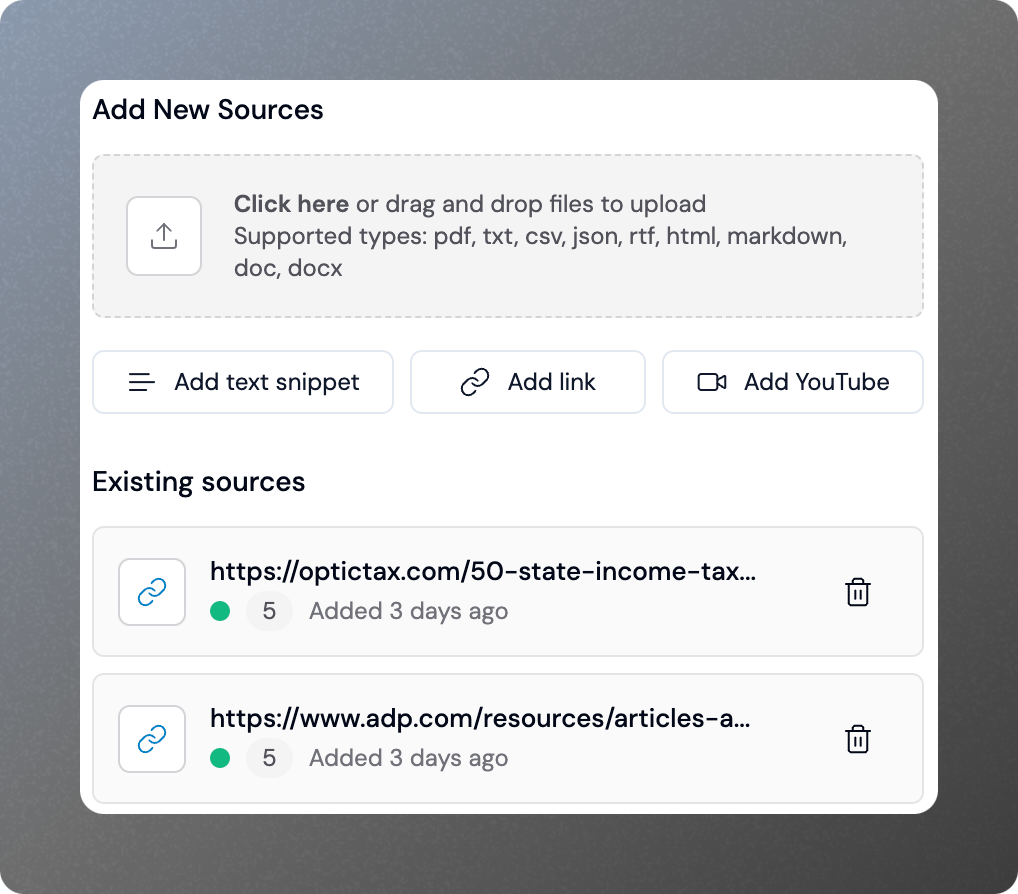

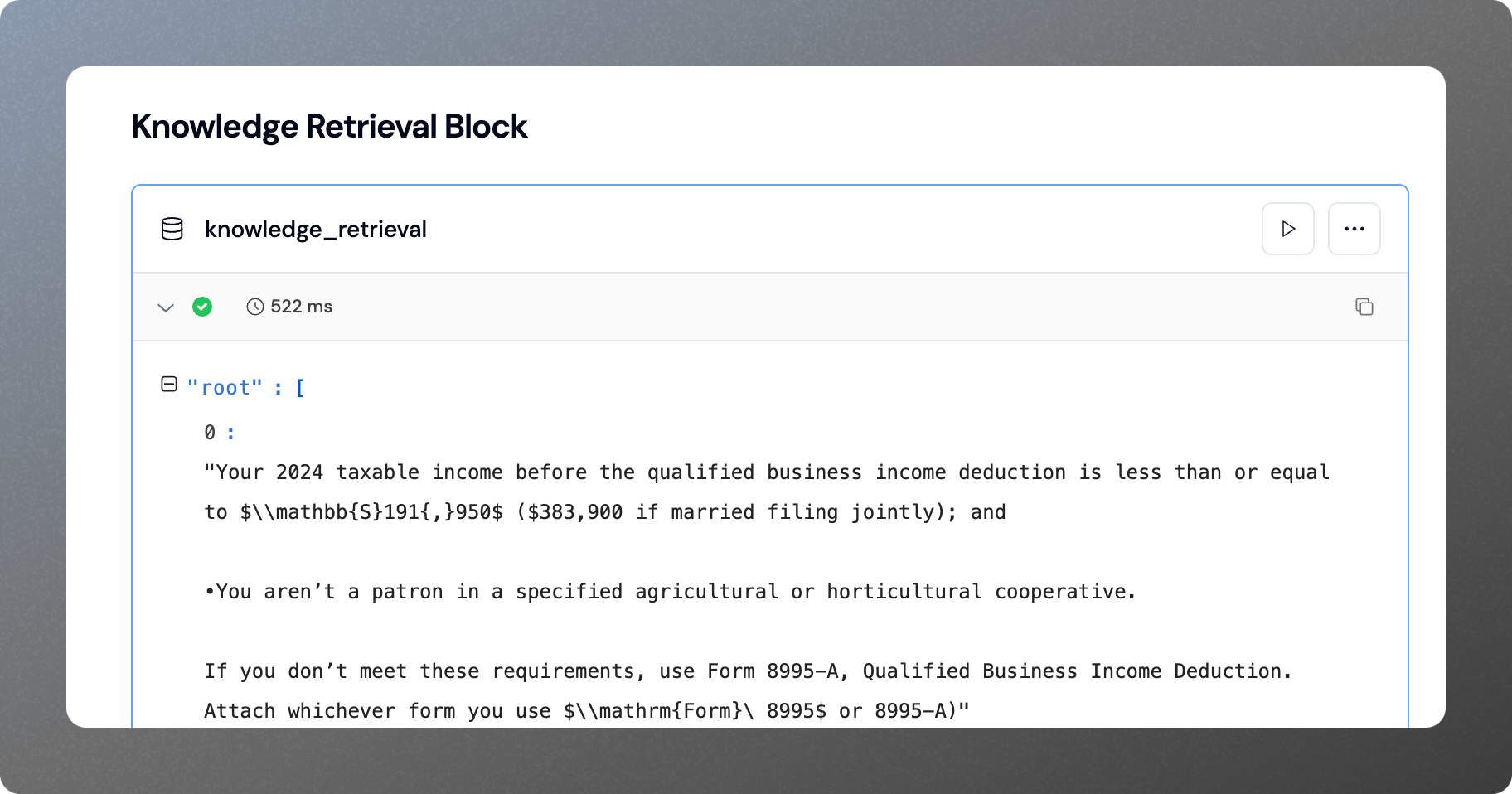

Step 2: Retrieving Information from URLs

The Knowledge Retrieval Block in Athina Flows fetches real-time data from trusted sources.

How It Works:

- Trusted Websites: Select URLs like:

- Search and Extract Data: AI scrapes relevant sections from these URLs.

- Rank and Filter Results: Only the most relevant content is used.

Example Retrieved Data:

| Source | Relevance Score | Extracted Information |

|---|---|---|

| IRS | 0.92 | "Small businesses can deduct expenses like office rent, utilities, and business-related travel expenses." |

| SBA | 0.88 | "Startup costs, home office deductions, and advertising expenses are deductible under current IRS rules." |

This retrieval process is fully automated within Athina Flows, requiring no manual intervention.

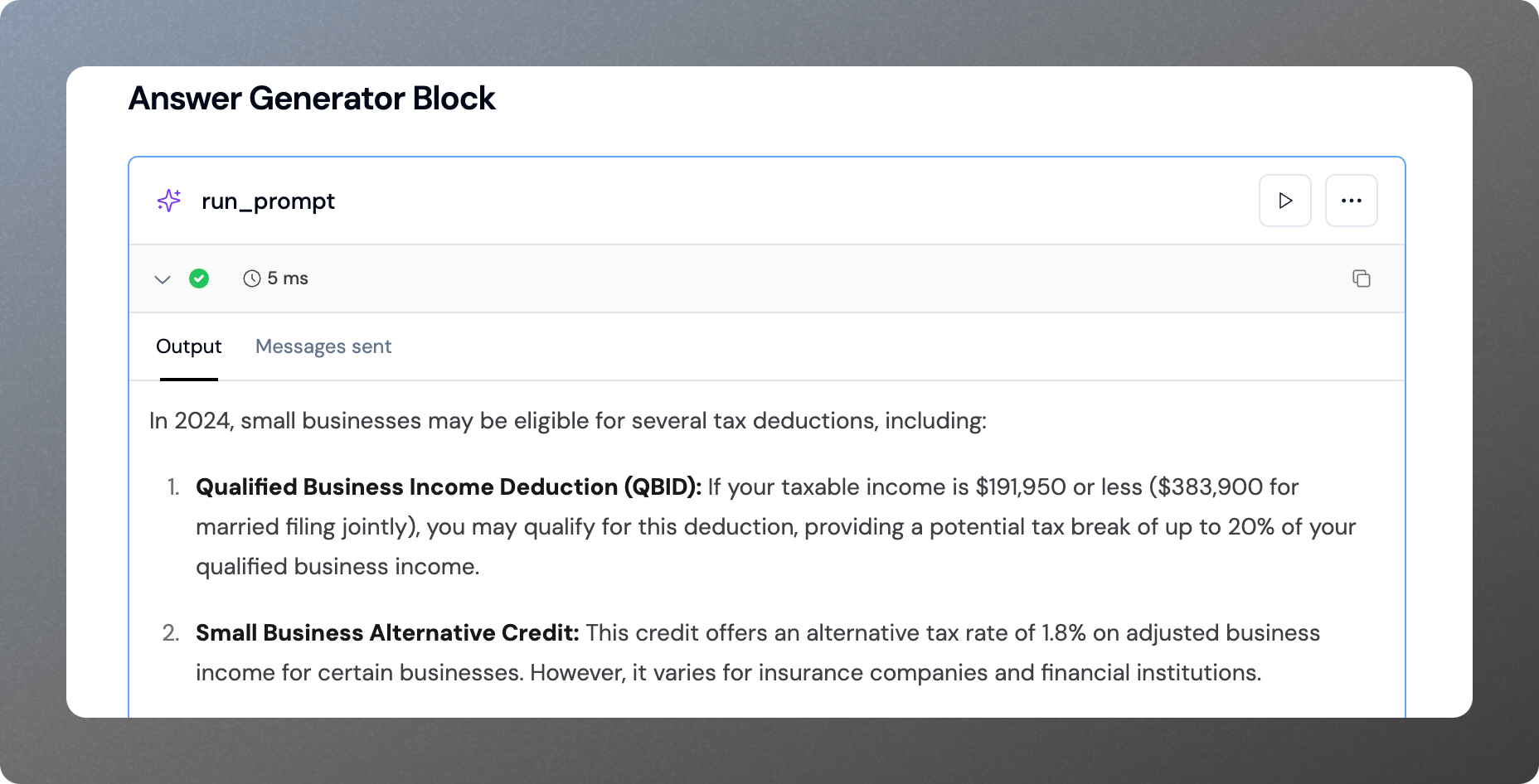

Step 3: Generating AI Responses

An Answer Generator Block, powered by an LLM, synthesizes the retrieved data into a structured, natural-language response.

Example AI Response:

In 2024, small businesses may be eligible for several tax deductions, including:

- Qualified Business Income Deduction (QBID): If your taxable income is $191,950 or less ($383,900 for married filing jointly), you may qualify for this deduction, providing a potential tax break of up to 20% of your qualified business income.

- Small Business Alternative Credit: This credit offers an alternative tax rate of 1.8% on adjusted business income for certain businesses. However, it varies for insurance companies and financial institutions.

Athina Flows automates the entire process, ensuring real-time, fact-checked, and cited responses to user queries.

Try out the Flow here

Conclusion

With Athina Flows, anyone can build powerful, no-code AI assistants that chat with websites in real-time. By combining RAG, URL-based retrieval, and LLM synthesis, AI applications can provide accurate, dynamic, and transparent information to users instantly.

Get Started Today

Want to build your own no-code AI assistant for chatting with websites? Try Athina Flows and start integrating real-time knowledge retrieval into your AI projects today!